washington state capital gains tax unconstitutional

USA March 8 2022. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid.

Washington Supreme Court To Challenge New Capital Gains Tax Bypassing Court Of Appeals

A Douglas County Superior Court judge in March struck down the new tax which.

. It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold. The state Supreme Court has repeatedly ruled that income is. Van Dongen on March 8 2022 Posted In Federal Tax Income Tax Local Tax Nationwide Importance Washington The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court.

OLYMPIA The state Supreme Court has agreed to hear a lawsuit regarding Washingtons new capital gains tax. A controversial capital gains tax passed by the Washington State Legislature in 2021 was ruled unconstitutional by a Douglas County Superior Court Judge on Tuesday. This Court concludes that ESSB 5096 violates the uniformity and limitation requirements of article VII sections 1 and 2 of the Washington State Constitution.

Washington Attorney General Bob Ferguson announced that he intends to. Jay Inslee signed the tax into law last May. GeekWire Photo John Cook A new capital gains tax in Washington was ruled unconstitutional by a lower court judge on Tuesday likely sending the.

Created in 2021 the tax. The Constitution provides that all taxes on property must be uniformly applied and cannot exceed an annual rate of 1. On March 1 2022 Douglas County Superior Court Judge Brian Huber concluded the Washington State capital gains tax CGT to be unconstitutional under the Washington Constitution.

Washington State Capital Gains Tax Held Unconstitutional By Troy M. The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. Washington State Enacted Capital Gains Tax Currently Held to be Unconstitutional Tax strategies 3222022 Key insights Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000.

The State has appealed the ruling to the Washington Supreme Court. It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on capital gains below that 250000 threshold the. Additional Information Judge hears oral arguments in capital gains income tax case Attorney General cant handle the truth about capital gains income taxes Advisory Vote 37 2021.

The State has appealed the ruling to the Washington Supreme Court. The Washington state capitol in Olympia Wash. The law imposes a 7 tax on sales that result in capital gains including for stocks bonds and other capital assets of.

But a state capital gains income tax is likely unconstitutional and would not be a reliable source of revenue according to the Washington Policy Center Under the state constitution property cannot be taxed at a rate greater than 1 percent and the taxes must be uniform. BIAW and the Washington Cattlemens Association filed a brief supporting the groups challenging the new tax. Earlier this year a Douglas County Superior Court judge deemed the states new capital gains tax unconstitutional as it would only tax the wealthy violating the states constitutional requirement for taxes to be levied uniformly across classes of property.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. Judge Huber an Inslee appointee ruled the 7 tax on. Washington State Capital Gains Tax Held Unconstitutional Thursday March 3 2022 The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by.

The lawsigned by Governor Jay Inslee last. Here the capital gains tax does not apply to everyone and therefore is not uniformly applied and the rate is 7 Heres a wrinkle weve not heard discussed. Capital gains tax In March of 2022 the Douglas County Superior Court ruled in Quinn v.

61 of voters recommend repeal of capital gains income tax. On March 1 2022 the Douglas County Superior Court ruled that Washingtons new capital gains tax is unconstitutional. A capital gains income tax is unconstitutional in Washington.

If passed Washington will be the only state without an income tax with a standalone capital gains tax. The tax enacted in 2021 would have imposed a seven percent tax on long term capital gains over 250000 reported by Washington residents and other individuals on their federal income tax returns. Capital Gains Tax Unconstitutional March 7 2022 BIAW celebrated a huge victory in the courts when a superior court judge ruled Washingtons controversial capital gains income tax was unconstitutional.

Inside Washington Retail. On Tuesday March 1 2022 Washington State Superior Court Judge Brian Huber released a ruling striking down the states new capital gains tax. Jay Inslee speaks before signing a bill into law in Tukwila Wash Tuesday May 4 2021 that levies a new capital gains tax on high profit stocks bonds and other assets for some residents of Washington state.

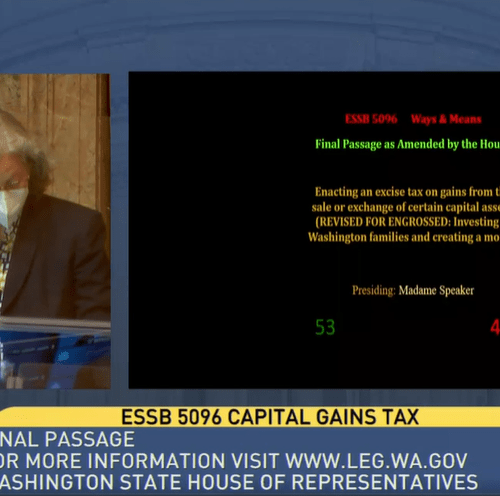

Washington Senate Passes Unconstitutional Capital Gains Income Tax Matt Owens 03312021 Washington State is considering a new capital gains tax SB 5096 that would levy a 7 percent tax on profits from selling stocks bonds and other assets. Washington still banking on unconstitutional capital gains tax revenue By Brett Davis The Center Square Apr 4 2022 Washington Gov.

Eur Lex 52021sc0185 En Eur Lex

Governor Signs Washington Capital Gains Tax Into Law As Legal Challenges Loom Northwest Public Broadcasting

Eur Lex 52021sc0185 En Eur Lex

Washington State Capital Gains Tax Held Unconstitutional

Judge Overturns Washington S New Capital Gains Tax The Columbian

Governor Signs Washington Capital Gains Tax Into Law As Legal Challenges Loom Northwest Public Broadcasting

Capital Gains Tax Repeal Campaign Folds Washington State Wire

Eur Lex 52021sc0185 En Eur Lex

Washington State Capital Gains Tax Held Unconstitutional

Overview Of Washington State Tax Law Changes Beginning January 1 2022 Neither Definitive Lasher Holzapfel Sperry Ebberson Pllc Jdsupra

Appeals Court Rules Seattle Can Have Income Tax Economic Opportunity Institute Economic Opportunity Institute

Wa Legislature Passes Capital Gains Tax On Sales Above 250 000 Annually R Seattle

Campaign To Repeal State S Capital Gains Tax Raises Nearly Twice As Much As Its Opponents Kiro 7 News Seattle

Arizona Flat Tax A Flat Income Tax Of 2 5 Percent In Az Tax Foundation